how to declare mileage on taxes

If the determined fair market value exceeds the threshold for repairs your insurer often declares the vehicle a total loss. GSA cannot answer tax-related questions or provide tax advice.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Updated with mileage rate deductions from 6 April 2017.

. For your 2022 taxes the next quarterly estimated tax deadline is coming up on September 15 2022. How do I file my taxes with TurboTax Online. You risk losing your refund if you dont file your return.

Depending on your age filing status and dependents for the 2022 tax year the gross income threshold for filing taxes is between 12550 and 28500. Selectmen to make rate bill when town fails to lay sufficient tax. However if you skip making a quarterly payment or pay late you may be subject to a penalty.

Property jointly owned but not with a spouse or civil partner. Have a question about per diem and your taxes. Most countries require travellers to complete a customs declaration form when bringing notified goods alcoholic drinks tobacco products animals fresh food plant material seeds soils meats and animal products.

If you want to claim gas. RNs can earn up to 2300 per week as a travel nurse. Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses.

You can make payments via Mpesa. The rate is 016 for 2021. XLSX - 44 KB State Tax Exempt Forms.

The guidelines for large cash transactions for banks and financial institutions are set by the Bank Secrecy Act also known as the Currency and Foreign Transactions Reporting Act. If you have no PAYE to declare you are required to submit a NIL return. Use the KRA Pay bill number 572572.

Claiming mileage or gas for taxes depends entirely on your personal situation. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes. A customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory countrys borders.

Or mileage you used to bring items to a donation site. To claim the Earned Income Tax Credit you must have earned income. Ask questions get answers and discuss topics with experts and users alike.

Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. If you deposit more than 10000 cash in your bank account your bank has to report the deposit to the government. If you have self-employment income youre required to report your income and file taxes if you make 400 or more.

If you choose to take the standard mileage you can claim 585 cents per mile during 2022. You can claim 16 cents per mile driven in 2021 but theres a catch. Connect with us to share and inspire.

The main factors that determine whether you need to file taxes include. For the year you are filing earned income includes all income from employment but only if it is includable in gross income. After filing the return online you are required to generate a payment slip via iTax which you will present at any of the KRA appointed banks to pay the tax due.

The same rule applies to a right to claim tax credits such as the Earned Income Credit. Get help understanding taxes using TurboTax and tracking your refund after you file. In general you are expected to pay estimated taxes if you expect to owe 1000 or more annually for your taxes.

If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date. To claim tax deductible donations on your taxes you must itemize on your tax return by filing Schedule A of IRS Form 1040 or 1040-SR. Mileage accrued when driving to and from doctor visits the pharmacy and the hospital can all count toward a medical deduction.

Mileage for medical care is included in your medical deduction. When any town has failed to lay necessary taxes or to lay a tax which in addition to the other estimated yearly income of the town is sufficient to pay the current expenses of such town its selectmen shall make a rate bill upon its list last completed for the amount necessary or for an amount sufficient to pay. Limitations to know about when claiming mileage on your taxes.

There are a few times when you wont be permitted to claim the standard mileage rate option. The rate is 014for 2021. Mileage for volunteer work is included in your charitable deduction.

Then it issues a total-loss payoff settlement if vehicle damage is covered in your policy typically under collision and comprehensive insurance and the accident resulted from a covered incident. You both need to declare beneficial interests in joint property and income. How do I pay for PAYE.

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Federal Tax Laws On Mileage Reimbursement Turbotax Tax Tips Videos

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

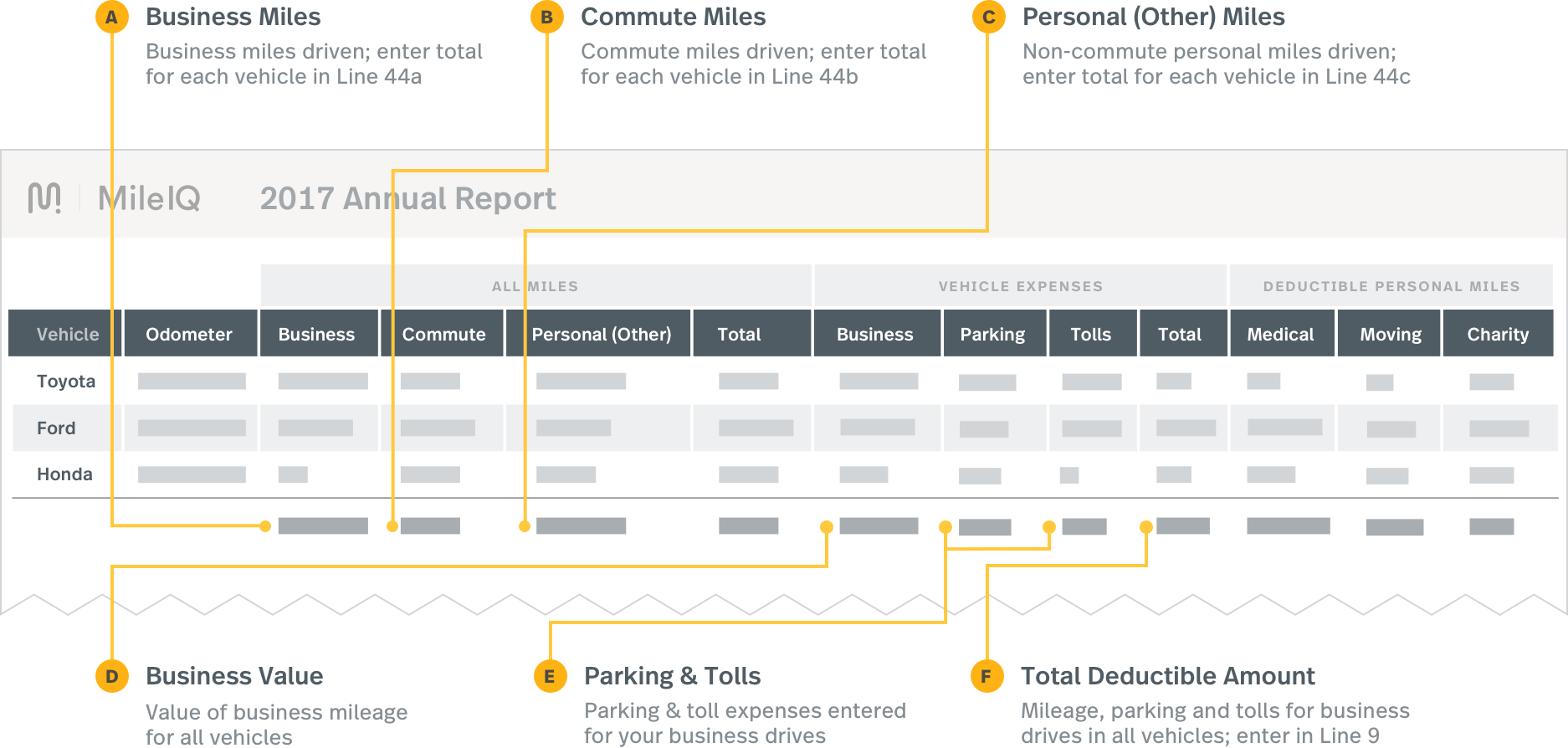

Reporting Mileiq Mileage With Tax Software Mileiq

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

25 Printable Irs Mileage Tracking Templates Gofar

What Are The Mileage Deduction Rules H R Block

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

:max_bytes(150000):strip_icc()/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Standard Mileage Rate Definition

Self Employed Mileage Deduction Rules Your Guide To Deducting Mileage

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mileage Vs Actual Expenses Which Method Is Best For Me

Self Employed Mileage Deduction Guide Triplog

Self Employed Mileage Deduction Guide Triplog